How to Select and Justify a Configuration Data Management Software Tool (Part 1)

Whether you can no longer get by with performing Configuration Data Management (CDM) utilizing shared drives and spreadsheets, or your legacy CDM solution has just reached the end of its usefulness, you have decided it is time for a new software tool.

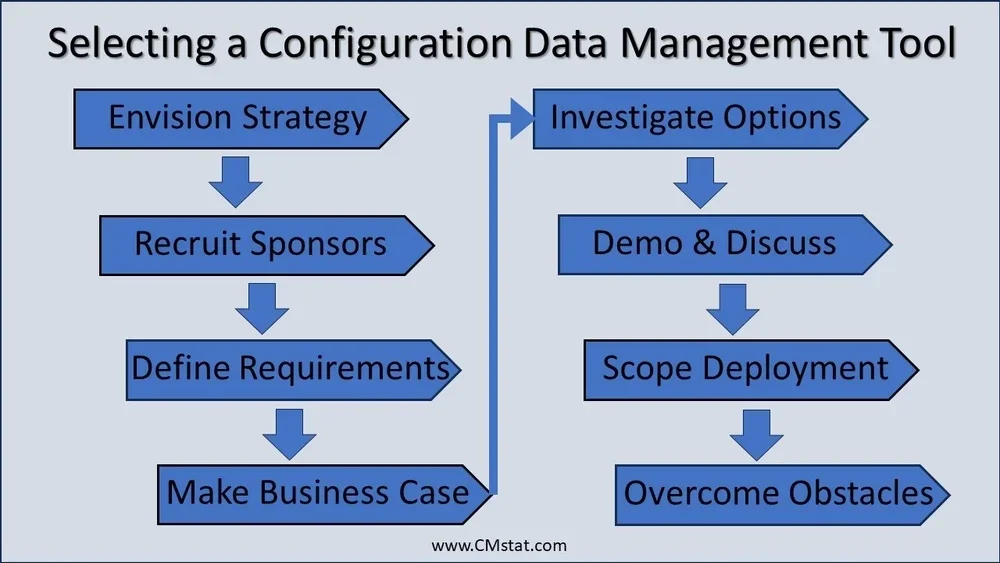

So, what then are your next steps in selecting and justifying that new CDM tool? In this series of CMsights posts, Dave Allen, CMstat’s Aerospace & Defense Industry Ambassador, will review steps in the selection processes he has often seen used over his career, as well as those steps which are often overlooked or occasionally misused.

In Part 1, Dave begins by sharing an outline of eight recommended steps that will be followed in subsequent posts by a deeper dive into the most important elements. With the added insights of Lisa Fenwick, CMstat’s Vice President of Customer Support, he will also identify predictable obstacles and unexpected detours along the way for which CDM managers should be prepared to encounter and overcome.

Step 1 – Define (or Update) Your Vision and Strategy

Are your organization’s historic expectations and fundamental approach for CDM still valid given all the changes to your business, products, suppliers, and customers? And especially when considering the rapid evolution, if not disruption, of new technologies like MBSE, SaaS, and AI? Furthermore, is your organization able to fairly assess alone without the perspective of others who may have worked elsewhere and can offer different experiences?

As just one example, do you want CDM applications to operate within a federated solution architecture where multiple industry-specific tools work together, each consuming and adding intelligence to the digital thread? Or do you desire a single enterprise solution strategy where all the data and processes of engineering, manufacturing, and supply chain are managed in one monolithic application? Read more about the pros and cons of this important strategy decision HERE that is creating much timely discussion across our industry.

Step 2 – Gain Sponsorship from Leadership Early On

I have witnessed many times the CDM team wants a new tool but when it goes up the chain of command for approval the idea is quickly shot down without much discussion. Gaining a sponsor before embarking in earnest on this journey is highly recommended. You need someone at a leadership level to champion your initiative, especially when many deliberations may be held when you are not at the table. Some tips can be found in these articles Elevating Configuration and Data Management Inside a Company and The Role of Configuration Management Champions.

Remember though, that any executive who has the authority and budget to support your efforts will likely care less about technical arguments and more about how does the investment of resources (time, money, alternative costs, etc.) impact the financial bottom line, improve performance, reduce risk, or better yet, support an existing corporate priority that already has much visibility and funding.

Step 3 – Document Your Processes and Requirements

Are your CDM processes adequate or do they need an update before going any further? A new software tool will not help a bad process; it may just make them worse, faster. Think of the ‘garbage in garbage out’ principle. This article Configuration Management Assessment FAQ will be helpful to you in assessing your current process before you get started with tool selection

Requirements definition does not have to be a huge sub-project into itself. It can simply be a specification document outlining what functions the tool needs to perform, including inputs and outputs, with all the likely deviations. The use of illustrative workflows and use cases is a best practice in requirements definition. And this is especially important, be sure to get concurrence from key workflow stakeholders and consumers of data outside of the core CDM team.

Don’t forget to consider less-functional requirements such as usability, configurability, deployability, security, interoperability, affordability, and adaptability as requirements change in the future. For some industries and applications, the support of standards like EIA-859 may also be important.

Step 4 – Construct a Business Case With Narrative

A good place to start is with what the current tool set, or lack thereof, is costing in terms of organizational productivity, product failures, lost data, project scheduling, manufacturing or supplier reworks, business profitability, customer reputation, team morale, and employee retention. This will help you gather the projected cost savings and cost avoidances from improvements a new tool will provide.

This may also be the opportune time to develop a metrics baseline of the as-is performance of existing processes and tools. This will then provide the data to demonstrate improvements once a new tool is implemented.

Like requirements definition, preparing the business case can become a substantial project. I have found that the most compelling cases are not necessarily the most complete “boil-the-ocean dry” analyses. Instead, they are often the simplest narratives that anyone within the organization will immediately get without a great deal of explanation required. An example is using a recent problem that caused a major failure, performance anomaly, project delay, or customer embarrassment.

Finally, while most executives say they expect a solid Return on Investment (ROI) in a business case, what may motivate quicker action is the perceived Risk of Failure (ROF) to their organization, or to them personally, for not doing something. Read more about getting managers to care HERE.

Step 5 – Identify then Investigate the Options

Looking for solutions and engaging providers should not be the first or even an early step in the process! If it is, the risk is that your strategy, requirements, and priorities have already been biased, if not hijacked, toward what the vendor community wants them to be instead of what you need of them.

Tool providers are not hard to find, if they don’t find you first. Beware of internet searches that are rarely clean as the results may be polluted by your web profile and previous searches, with paid rankings and click-bait making the whole process a frustrating exercise in being manipulated. The use of AI in performing market research does have its role, but again, beware that the AI bots may be propagating questionable information it finds on the net from those who are now learning how to feed and manipulate AI to their advantage, just like we have seen in internet search engines.

So for these reasons, I suggest working your personal career network and asking about tools your current and past teammates have used. Or better yet, use this as an excuse to expand your contacts into other companies and professional associations. I recommend resources provided by less commercial sources like CMPIC, CIMdata, DAU, and The PLM Ecosystem Atlas.

Step 6 – Set Up Discussions and Demonstrations

I would not rely on a vendor’s presentation to assess if the tool can meet your requirements as I have seen too many instances where the “slideware” product does not reflect actual capabilities currently in the software. Once you have identified a short list of providers that are contenders to fit your requirements, scheduling live demonstrations of your workflow use cases are recommended. If the vendor has not asked enough about your use cases to demonstrate them using their product, that is a warning sign. But the converse can also be true; if they have focused exclusively on a narrow use case, the risk is that they may have fabricated capabilities that are not native to the software.

Don’t forget that demonstrations are not just of a vendor’s product, but also of their style of communication and collaboration with customers. I have found there is as great a range in the commercial personality of vendors as there is in their product offerings. While a vendor’s sales team will typically be the best at this, their corporate culture attitude toward collaborating with instead of selling to customers will become obvious.

In a subsequent post I will be discussing important questions to ask and functions to see demonstrated before selecting a tool and vendor. Until then, I encourage you to explore what one provider, CMstat, openly shares as the applications, capabilities, and functionality of its product EPOCH. I have found no other online CDM product summary as transparent and complete as this one.

Step 7 – Scope the Implementation Plan

I recommend a preliminary implementation plan be developed as part of the selection process, not afterwards, as each plan may be as different as the tool selected. It is not unusual that depending on the solution strategy, the complexity and cost of deployment, including data migration, can be greater than that of the actual tool.

The plan should be a detailed schedule of all the tasks you need to perform to smoothly transition to the new tool. Consider if there is data you need to migrate and how you will do that. Bring in IT to discuss seats and licenses. Think about the training you (or the vendor) will need to do to get your tool users ready to go on day 1.

For example, the new tool will almost certainly be different than your current one in terms of steps and clicks needed to execute your process. The users will need to be trained and the creation of process aids will be required. Will the CDM team perform this training and ongoing handholding, or will the vendor provide it?

Don’t forget that having a plan for implementing a CM tool is not the same as having a Configuration Management Plan as this article on CM Plans explains.

Step 8 – Prepare for and Overcome Obstacles

Despite all of the above, the best professionals and planning will still encounter objections and obstacles along the way. These can be based on a myriad of factors ranging from technical, financial, procedural, political, and even personal differences masquerading as organizational priorities. I have written about a few of these in this recent CM Coaches blog at:

Who makes the tool decisions in your organization?

Why spreadsheets and shared drives aren’t a substitute for a CM DM tool?

What tools are currently being used across industry?

Yet, do not despair! Objections can be a healthy sign that important decisions are being made and the stakes are high to get them right. This is a signpost of success, not failure, in raising the imperative for and status of effective CDM within an organization. The best strategy to deal with these impediments is to address them upfront, not avoid them, but then quickly pivot to the compelling business case narrative you have constructed that hopefully makes them less significant.

Finally, it not unusual that the first pass through the request for a new tool will result in either inaction or a response of “not at this time.” Again, don’t consider this a failure. If the above steps have been executed well, you will have laid the groundwork for another attempt when the importance of the CDM function is better understood and more respected across the organization.

Coming Next…

In future posts in this series, I will share additional insights into the more important steps, including some from my colleague Lisa Fenwick who will share examples from the numerous evaluations and implementations of CDM tools she has participated in over the years.

Until then, I would welcome hearing about your experiences and recommendations with tool selection. In particular, which of the above steps do you are most important or underappreciated? Please comment publicly below or send a private email to dallen@cmstat.com.

Receive CMsights

Subscribe to CMsights News for the latest updates from CMstat on Configuration Management, Data Management, EPOCH CM, and EPOCH DM.

Request a Demo

See how EPOCH CM and EPOCH DM support industry standards and best practices in Configuration Management and Data Management.